With so many choices out there, which credit card fits your spending habits to maximize value? Use this tool to compare 20 of the most popular beginner to mid-tier credit cards out there!

The credit card list includes:

The breakdown by bank is as follows:

How to use the tool:

- Click the OneDrive Link above or here

- Click “Download” at the top right corner of the screen

- Once downloaded, click “Enable Editing” to activate the workbook

- The workbook is split up into 5 sections:

- Enter your monthly expenses by bucket:

- Select limiting criteria (i.e. I only want to return cards with no annual fee or only Visa cards)

- Refresh PivotTables and analyze cards available (Click here to learn more about PivotTables)

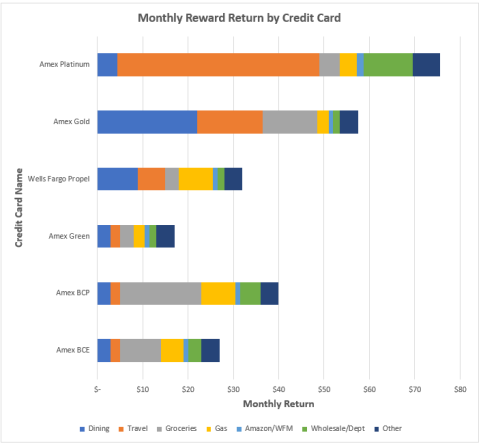

- After the refresh, the stacked bar chart should update automatically to show the breakdown of rewards by category:

- Enter your monthly expenses by bucket:

There are some assumptions:

- It’s hard to compare membership points in an apples to apples comparison; some membership points may have more value than others

- Some cards offer rotating categories; in these cases, points awarded may not be perfect

- Chase Ultimate Rewards points are counted with multipliers for that specific card; using them in tandem will boost rewards.

- Reserve has a 1.5x multiplier (factored in)

- Preferred has a 1.25x multiplier (factored in)

- All others are 1x multiplier (unless otherwise stated)

- With some cards, especially higher end cards, there may be hard to quantify perks such as dining/travel credits. The value may not be consistent from person to person. That being said, any credits are factored into the annual returns. Examples:

- Amex Platinum:

- $200 Uber

- $200 Airline

- $100 Global Entry

- $100 Saks Fifth Ave

- For more information, here is a detailed review done by The Points Guy on 10/31/18

- Chase Sapphire Reserve:

- $300 Travel Credit (much more liberal than Amex)

- $100 Global Entry

- For more information, here is a detailed review done by The Points Guy on 8/17/18

- Amex Gold:

- $120 Dining Credit

- $100 Airline

- For more information, here is a detailed review done by The Points Guy on 11/6/18

- Amex Platinum:

- With some cards, especially higher end cards, there are other hard to quantify perks such as access to priority pass airport lounges, hotel statuses, car rental insurance, cell phone insurance, trip cancellation services, concierge services, etc. These have not been factored into the calculations.

Please keep in mind…

This tool is merely to give an idea of how some cards can shine over others depending on the inputs given. Please do not let this tool completely dictate your decision, as there are numerous other factors that this model does not take into consideration (i.e. how many hard inquiries you have, long term strategy, other cards you hold, what you value, etc.)